Key Learning

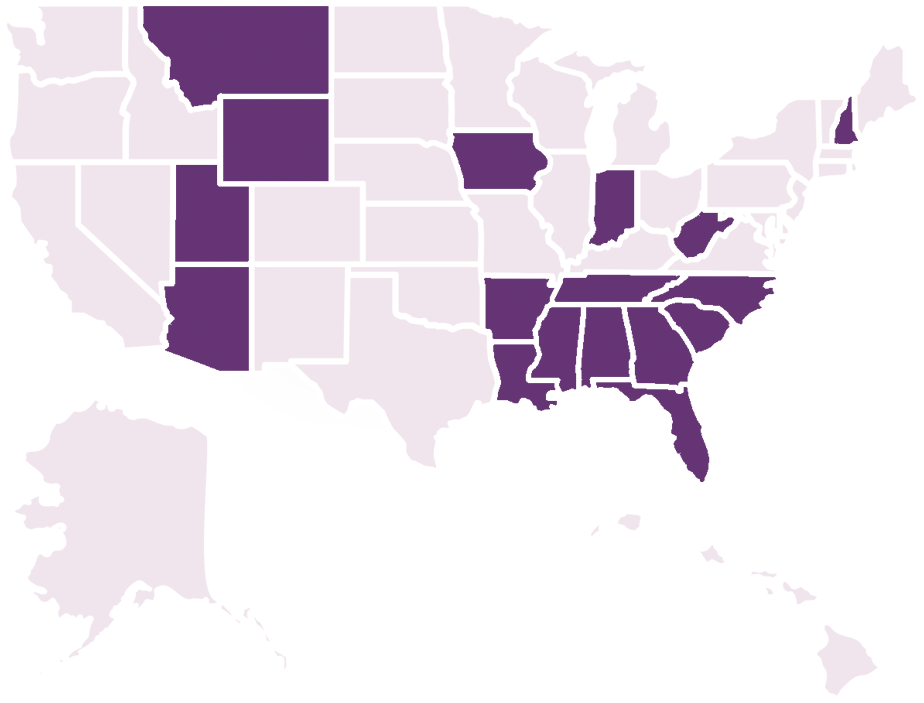

See How the States Stack Up

This user-friendly platform is designed to help you navigate the diverse landscape of Education Savings Accounts across different states. This tool offers a comprehensive comparison of ESA programs by state.

Directions

From the list of state programs below, you can choose up to three programs to compare. The results will show you a comprehensive overview of the particular policy features included in the design of the program.

With this tool, you can compare state programs, analyze program features, and make informed decisions.